U Ethical is an award-winning, not-for-profit fund manager with a long-term investment track record. We are ethical investing specialists, with a clear and consistent focus on ethical investing since 1985.

U Ethical’s investment team manages a range of asset classes: Australian and international equities, fixed income, cash, and multi-asset portfolios for both wholesale and retail clients.

The team ensures strict adherence to our ethical investment policy, ESG integration, and stewardship across all strategies. With over 100 years of combined experience in investment management, wealth management, research, and ESG/sustainability, the team brings deep expertise to every decision.

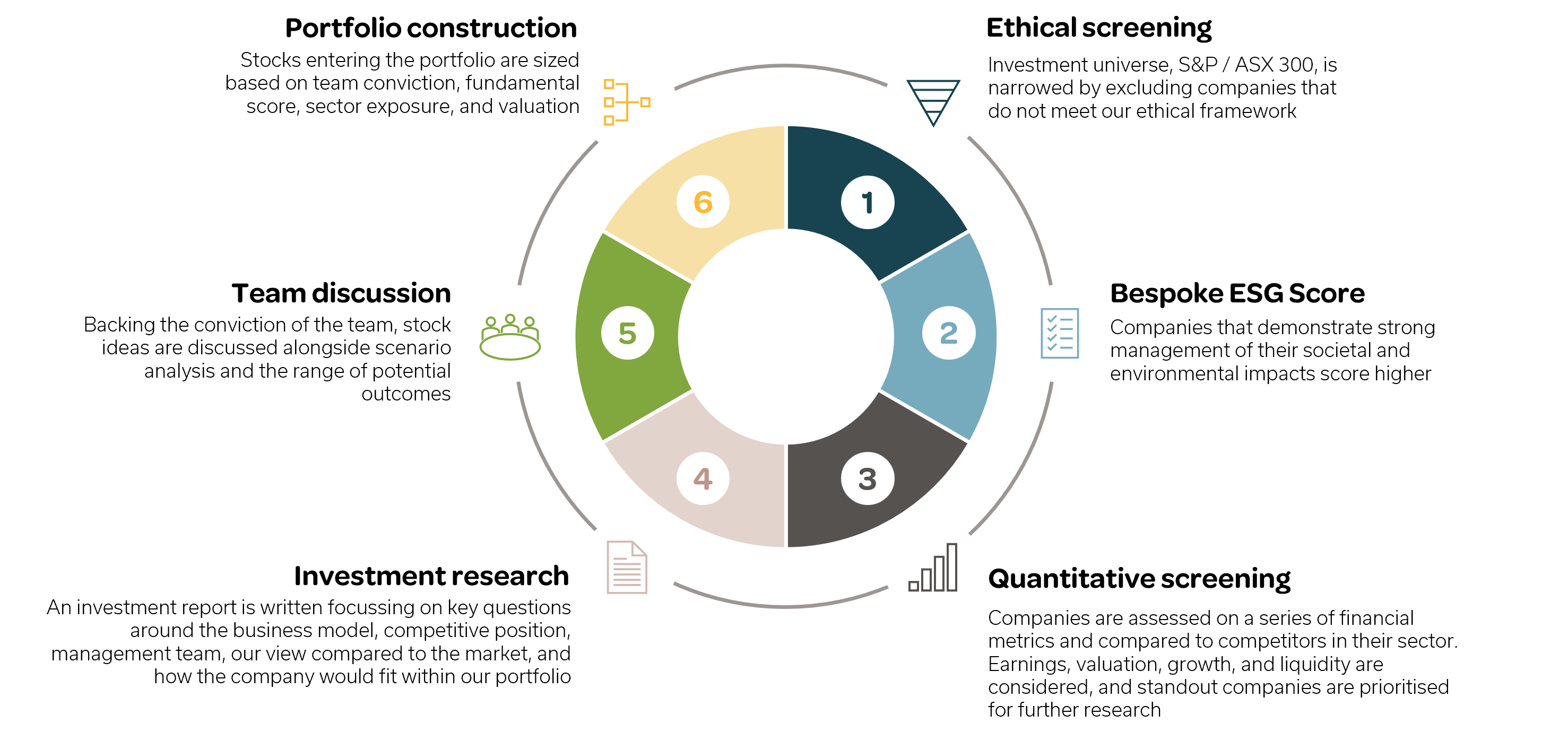

Our investment process seeks to ensure that our portfolio holdings are aligned with our clients’ financial and ethical expectations. The application of our Ethical Investment Policy varies depending on the asset class.

For Australian equities, we apply a top-down approach to define our investable universe, excluding companies and issuers involved in industries or activities that conflict with our Ethical Investment Policy, using strict materiality thresholds.

U Ethical’s investment process integrates environmental, social, and governance (ESG) considerations to minimise risk and identify growth opportunities. Guided by our ethical philosophy, we target companies that demonstrate strong management of their societal and environmental impacts, adhering to industry best practices, standards, and voluntary frameworks.

These ESG considerations also drive our stewardship activities and inform our participation in collaborative investor initiatives.

We actively monitor companies and issuers through ESG alerts, broker research, and media outlets, conducting monthly ESG reviews and interim reviews when necessary—for instance, in response to significant controversies, misconduct, or unethical business practices.

We seek to invest in issuers that align with our Ethical Investment Philosophy through positive contribution. This information constitutes a part of our overall ESG score for issuers. We utilise the MSCI ESG Sustainable Impact Metrics (SIM) framework for an initial screen.

Alternative energy

Energy efficiency

Green building

Sustainable water

Pollution prevention

Sustainable agriculture

Education

SME finance

Connectivity

Nutrition

Major disease treatments

Sanitation

Affordable Real Estate

Source: MSCI ESG Research, MSCI ESG Business Involvement Screening Research, Global Sanctions, and Sustainable Impact Metrics Methodology Summary Guide for Corporate Issuers, October 2022.

We do not invest in issuers directly deriving revenue or earnings from the following activities:

Controversial and nuclear weapons

Tobacco production

Nuclear power generation

We do not invest in issuers which exceed a materiality threshold of 5% of revenue or earnings directly from the following activities:

Fossil fuels*

Uranium mining

Conventional weapons and civilian firearms

Predatory lending

Gambling

Adult entertainment

Animal cruelty and exploitation

Alcohol production

Tobacco distribution

Tobacco retail

*Coal mining, oil and gas production, power generation and equity ownership. The fossil fuel criterion does not apply to fixed income securities where the issuance is aligned with the International Capital Market Association’s (ICMA) Use of Proceeds Principles for green bonds and transition finance and is externally verified by a third-party provider.

We do not invest in issuers that derive more than 10% of revenue or earnings from the following activities

Alcohol distribution

Alcohol retail

Business involvement screening measures companies’ direct and indirect exposures to specific products and services, quantified as percentages of total company revenue and total company ownership.

We use MSCI Business Involvement Screening (BIS) to provide another lens of analysis which captures revenue and earnings exposure for companies and issuers covering a parent or holding company and direct company subsidiaries.

‘Ownership of’ involvement – this factor captures companies that own from 20% to 49.99% of a company with involvement in the business activity listed in U Ethical’s negative screening list; and

‘Ownership by’ involvement – this factor captures companies that are 50% or more owned by a company with involvement.

U Ethical monitors companies or issuers who are or have been involved in controversies. We generally exclude companies or issuers involved in very severe controversies in the last 12 months.

If more than 12 months have passed since a company or issuer had a very severe controversy, a qualitative analysis is undertaken to review the company’s response and its efforts to resolve and – where required – remediate.

We also screen out companies that fail to meet international global norms and conventions.

Cash, cash equivalents and term deposits are only exposed to the financial services sector (predominantly banks) and given the nature of the underlying investments this limits full application of negative screening. The focus on screening for these issuers is on issuer controversies and overall ESG profiles. U Ethical also engages with companies in the financial services sector on a range of material ESG and ethical issues.

Please refer to our Ethical Investment Policy for definitions.

U Ethical’s investment approach includes building an ethical/ESG profile that identifies risks and opportunities and is completed prior to any investment.

As an ethical and responsible investor, we hold the companies in which we invest to high standards.

The information provided is general information only. Before acquiring a U Ethical product, you should read the disclosure document(s) for the product and seek independent advice to ensure it is appropriate for your particular objectives, financial situation and needs.

The disclosure documents are available from this website and contain details of the issuer of each product. U Ethical is a registered business name of Uniting Ethical Investors Limited ABN 46 102 469 821 AFSL 294147.

We acknowledge Aboriginal and Torres Strait Islander peoples as the traditional owners and original custodians of the lands and waters on which we all live and work. We pay our respects to Elders past and present.

©2025 Uniting Ethical Investors Limited